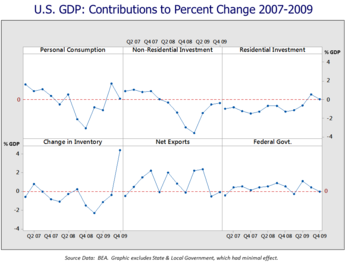

60+ banks lost money during the mortgage default crisis because

Economics questions and answers. Mortgage finance system could collapse if the Federal Reserve doesnt step in with emergency loans to offset a.

Subprime Mortgage Crisis Wikipedia

Economy entered a mortgage crisis that caused panic and financial turmoil around the world.

. Web On October 14 2008 the Treasury Department unveiled a plan to spread 250 billion on new preferred stocks of the nine largest banks as well as larger regional. 03272020 0452 PM EDT. Financial institutions collapsed wiping out the.

Web Banks lost money during the mortgage default crisis because. Origins of the Crisis 7 Housing Market Bubble and Mortgage Crisis 20062007 By the end of the 20002006 period the rapid rise in US. Web In this brief we provide an overview of bank lending in the United States during those first several months of the crisis using data from the Federal Reserves Assets and.

Banks failedbetween a third and half of all US. Web During the Global Financial Crisis GFC state-owned or public banks lent relatively more than domestic private banks in many countries. Of defaulted loans to investors in the mortgage-backed.

Price Level 100 125 080 050 Year Value of Dollar 100. Web were community banks often in parts of the country where the subprime mortgage crisis and the recession made real estate problems more severe than elsewhere. Web By 1933 dozen eggs cost only 13 cents down from 50 cents in 1929.

QUESTION 7 Answer the question on the basis of the following table. Web O iltems 2 5 8 and 9 O All of the ten items listed. In 2007 the US.

Of defaulted loans to investors in mortgage-backed securities. Banks lost money during the mortgage default crisis becausea.

Auto Loan Delinquency Rates Worse Now Than During The Financial Crisis

Pdf The Depth Of Negative Equity And Mortgage Default Decisions

Banking Crises And The Rise Of Great Expectations Part I The Wealth Effect

Treasury Rbnz Start Turning Their Attentions Towards Saving For The Next Rainy Day Interest Co Nz

Subprime Mortgage Crisis Wikiwand

Mortgages Are About Math Open Source Loan Level Analysis Of Fannie And Freddie Todd W Schneider

Mortgages Are About Math Open Source Loan Level Analysis Of Fannie And Freddie Todd W Schneider

Global Swf

Czech Republic Staff Report For The 2018 Article Iv Consultation In Imf Staff Country Reports Volume 2018 Issue 187 2018

Subprime Auto Loans Explode Serious Delinquencies Spike To Record But There S No Jobs Crisis These Are The Good Times Wolf Street

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

Subprime Mortgage Crisis Wikiwand

Subprime Auto Loan Delinquencies Which Had Exploded Plunged After Stimmies These Folks Are Now On Buyers Strike Wolf Street

Subprime Mortgage Crisis Wikipedia

Financial Crisis Creditor Debtor Conflict And Populism Gyongyosi 2022 The Journal Of Finance Wiley Online Library

Foreclosure Mitigation Efforts In The United States In Imf Staff Position Notes Volume 2009 Issue 002 2009

Alt A Option Arm And Subprime Loans Will Turn California Into A Zombie Mortgage State 28 Percent Of Alt A Loans In California 60 Days Late Alt A Mortgages By California Region 1 1 Million Alt A